Our client was struggling with problems on their manufacturing plant floor that were driving their costs up and creating customer issues. Defect rates were far too high– as much as 22% on some lines. They also had excessive scrap. And frequent line shutdowns resulted in workers migrating to other lines – creating unnecessary buildups in WIP. Because most of the parts produced could be retooled, the material cost losses were minimal, but the labor cost of the rework hours were significant. Things were so out of control that all lines even had built-in rework processes, essentially normalizing the problem! Because none of this was accurately tracked, management didn’t have a clear sense of the size or cause of the problems.

We conducted a brief review of their operations and determined that the problems could be resolved by implementing Lean manufacturing principles. During our review we identified specific process and equipment deficiencies that needed to be addressed.

Background:

- “Fighting fires” was a way of life for our client.

- Lean processes would realize over $350,000 in annual labor savings, while at the same time creating 25% additional capacity.

As a result of the resulting implementation project, our client was able to:

- Reduced Team Sizes: During our review we discovered that disconnected processes and a lack of monitoring had resulted in crew overages of anywhere from 13 to 47%. We employed Lean principles to streamline operations, and recommended capital improvements such as investing in dual-head processes. Crew sizes were reduced by 25% on average, with an equivalent gain in productivity.

- Improved Use of Metrics: Many of the inefficiencies we uncovered had become ingrained processes due to a lack of actionable, OEE-based metrics. In short, no one had the data to illuminate how much EBITDA was being squandered. We implemented ongoing tracking for both training hours and offline rework labor hours. As we streamlined processes, we created clearly defined roles and responsibilities. We transitioned daily line monitoring to a Day-By-Hour model to create a line culture that is responsive to problems and keenly focused on schedule attainment. We trained management to draw maximum insight from the data they were accruing, empowered line personnel with problem-solving strategies, and developed and documented a streamlined change management process to hardwire oversight into future innovations.

- Setup Reductions: We introduced a “pit crew” approach to doing changeovers. By creating clearly defined roles and cross-training operators from other lines to assist in setup activities, we were able to cut time lost to no more than 3 hours (it used to take a full 8 hour shift to complete a changeover). We redirected kitting and prep from “what now?” tasks to proactive, “what’s next?” activities. And we created forward-facing training and troubleshooting models.

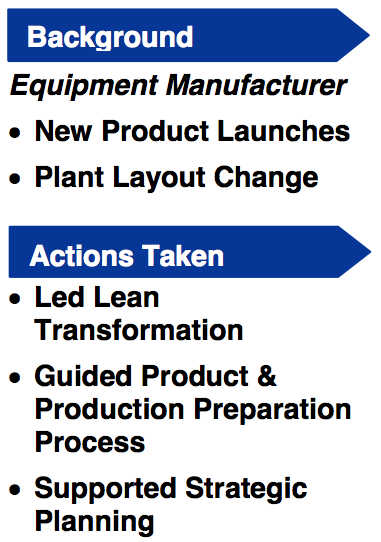

Actions Taken:

- Analysis of all processes

- Balanced line operations

- Built clearly defined roles

- Rolled packaging construction into process (one-piece flow vs. batching)

- Integrated training and metrics-gathering into operations

Impact

- Labor utilization savings $220,000/year

- Cost avoidance of 4 planned new hires: $166,000/year

- Reduced Burdened Labor Rate from $64/hr. to $49/hr.

- Dual Head rework reduced from 500+ units/shift to less than 60

- Reduced Rigid Line 4 defects from a high of 220,000 ppm to 0

Measurable Results:

- 22% crew size reduction overall

- $386,000/year in labor savings

- 25% capacity increase with current workforce

About The ProAction Group

ProAction is an operational consulting firm that works with Private Equity to do three things:

- Help you win good deals (and avoid bad ones!) through our pre-close “Q of Ops”.

- Help your management teams as they transition from an entrepreneurial approach to a scalable, process driven leadership path.

- Help you maximize the value of your portfolio companies through the implementation of operational excellence.

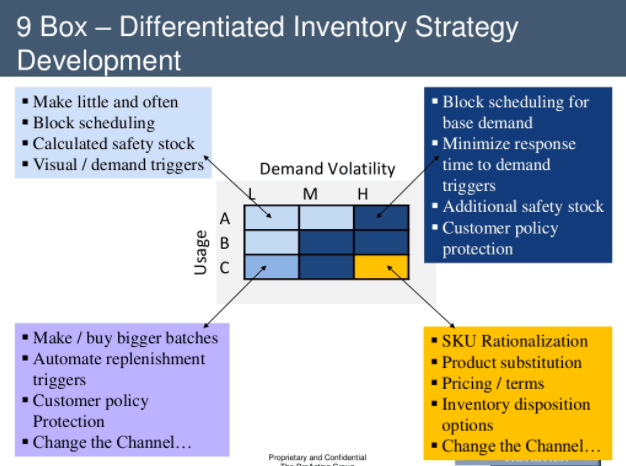

We focus on three sectors: consumer products, manufacturing and distribution. We have experts in Lean Manufacturing, Six Sigma, Sales and Operations Planning, Inventory Strategy, Sourcing, Logistics and Human Capital Development. We were founded in 1995 and are headquartered in Chicago.

For Further Information:

Timothy Van Mieghem

tvm@proactiongroup.com

The ProAction Group, LLC

445 North Wells Street

Suite 404

Chicago, IL 60654

Tel: (312) 371-8323

www.proactiongroup.com

The Competition is Fierce. Change the Rules. ™

The ProAction Group reinvigorated the

The ProAction Group reinvigorated the  The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets.

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets. Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included:

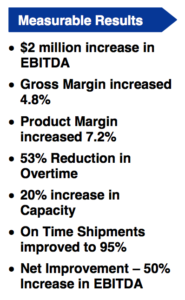

Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included: As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.

As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.