A couple of years ago we worked with a packaging company that had about $6 million in EBITDA. Initially, we projected that the company could increase EBITDA by about $1 million through the application of Lean principles. These opportunities weren’t hidden, just overlooked. There was a lot of work-in-process inventory. Some periods had high overtime, others excess capacity. Poor controls and a loose inventory strategy led to lots of frazzled customers, and the company compensated for these issues with expedited shipping.

By applying Lean principles, the company realized not $1 but $2 million in EBITDA improvements within 6 months. But here’s something that might surprise you: they also saw a 20% increase in capacity. In short, not only did existing business become more profitable, but the company could grow by 20% without adding additional capacity.

And those margins kept growing! Within a year, the management team actually realized $3 million in increased EBITDA and $1 million in reduced inventory. The company manufactured a 50% increase in EBITDA and built $30 million in market capitalization without increasing revenues.

Lean is a Philosophy

This is the difference between treating Lean principles like a one-time implementation plan, and the philosophy they truly are. Those new to the idea sometimes worry that adopting Lean principles will inhibit growth, but as you can see, that’s the furthest thing from the truth. In reality, waste often accounts for a substantial amount of your capacity, and reducing it puts time, money, and infrastructure back in the resources column. Transforming the culture of an organization around Lean principles yields very specific benefits, including increased scalability of operations, reduction in stagnant inventory, and a virtuous cycle of improvement.

Will Lean Impact Your Company?

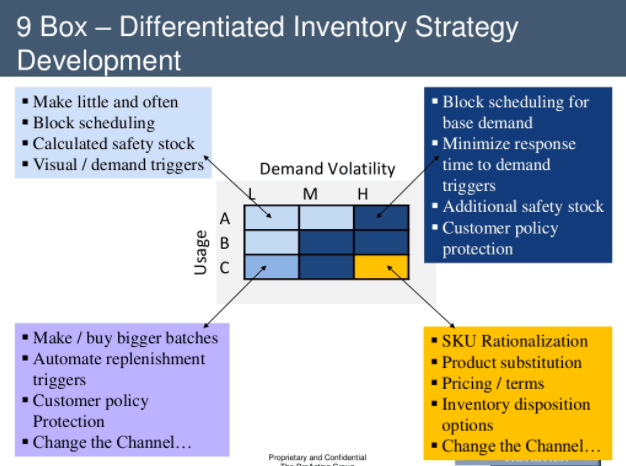

When estimating the potential impact of implementing a Lean model, there are some key indicators we look for. The most obvious problems involve inventory. We’ve already mentioned work-in-process materials. Excess inventory is another classic marker. The flipside, of course, is back-orders. All of these issues indicate that operations are not balanced correctly with customer demand, which is a problem we can help you fix. Unusually high levels of scrap, rework, and warranty costs are further signs of waste that can be eliminated.

Another indicator we often see is a lack of metrics and post-mortems. In companies that don’t monitor key performance indicators, we typically find opportunities for at least 10-15% improvement, and productivity goes up when KPI’s are reviewed during the shift or work day. After all, the fastest way to identify and resolve a problem is to take a look at actionable metrics while the events of the day are still fresh in your mind.

Another thing we investigate is downtime. We measure companies against the theoretical maximum production their facility could produce, then track down the source of any discrepancies between capacity and actual output. That’s where you have room to transition from cost savings to growth opportunities.

Lean Applies to All Business Models

Many types of companies can apply Lean principles. Obviously, with manufacturing companies we look at WIP inventory that’s languishing. We identify under- or ineffective utilization of existing assets. We quantify the extent to which excess product is tying up capital before there’s actual demand.

But Lean is just as useful for other models. In healthcare, it can be applied to patient care issues, like registration and wait times. Lean can help reallocate resources to address actual patient population and flow. It can streamline revenue cycle management.

Distribution companies can benefit from Lean as well. On time, complete and accurate fulfillment of an order is the distributor’s equivalent of good production. When working with these companies, we focus on pick times and accuracy, slotting methodologies, and manning tables and controls.

With business services companies, we can apply Lean to the processes that directly create the value customers pay for, as well as supporting processes that involve documentation, invoicing, and collection.

Lean Improves Higher Business Functions

The truth is, any company can benefit from applying lean to its support and administrative functions, like accounting, supply and demand planning, and even forecasting. While these areas do not directly add value to customers, they do impact a company’s ability to maintain an environment in which you can add value to customers and get compensated appropriately.

The main thing to remember is that Lean is not something you implement and then walk away from. It’s a philosophy, one which needs to be socialized until it’s a company-wide practice with champions at all levels of management. Fully implemented, it means less hands-on monitoring for your organization’s top leadership, enabling them to be more vision-driven.

Applying lean to your portfolio company will pay for itself in the short term with EBITDA and working capital improvements. In the longer term it will also develop additional capacity and a virtuous cycle of improvement. Make Lean part of your investment thesis and drive it!