When a mid-market company is delivering great profits and cash flow, it’s probably human nature to think, “We’re doing great” and get a little too comfortable. Rose-colored glasses don’t reveal where performance is well below where it could be.

Even when there’s every incentive to find out why a company’s results aren’t so good, it’s still tough for management teams and boards to spot all the areas where results can be improved. Conventional financial and operating metrics just don’t go deep enough.

Both causes of fuzzy vision pose a big problem for incumbent owners and management teams, because very, very few companies are performing at their full capabilities.

For private equity groups, though, management’s fuzzy vision presents a great opportunity:

- PEGs can develop better information during diligence and use that to advantage in their offer price.

- Post-acquisition, they can implement the improvements highlighted during diligence and rapidly boost performance and enterprise value.

9-Box & Pricing

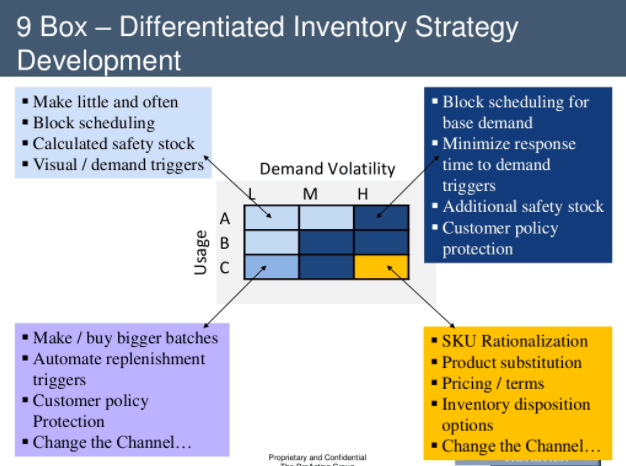

The ProAction Group’s 9-Box analysis is like having x-ray vision. It reveals the potential that lies beneath the surface to bump up EBITDA and lower the assets required on the balance sheet. It’s a powerful tool for PEGs that invest in manufacturers and distributors of standardized products.

In addition to showing where production and inventory management can be optimized, 9-Box analysis also indicates opportunities for pricing improvement.

Bob Sherlock of Marketwerks, a ProAction Group alliance partner, observes that “Management typically thinks that their prices are all right on the edge, about as high as they can be. They hesitate to take pricing action for fear that they’ll lose profitable volume. But every single company we’ve worked with was underpricing at least some of their products, for some customers, in some geographies and transaction types. The least risky pricing move in the world is to find where customers would willingly pay more, if you weren’t giving them the opportunity to pay less.”

“ProAction’s 9-Box analysis lets us see areas of underpricing, drawing inferences that we can validate in other ways,” Sherlock says. “The #1 factor in pricing is external—the prices at which enough customers will buy. But it’s also essential to understand prices at which the company should be willing to sell. The 9-Box process gives us insights into both of those.”

Case Study: Who is deciding pricing strategy?

We have a real world case study of a 9-box analysis. Here are the actual conclusions:

Case Study Conclusions

- Pricing, inventory and approach for “A” customers and “A” sku’s show that leadership understands where money is made. We got the important stuff right!

- Pricing strategy seems focused on managing “A” customers well. B and C customers get preferential pricing today.

- Increasing external customer margins to meet “A” Customer margins would increase B & C customer revenues and net income by $575,000. Driving B & C pricing to 4 points above A customer would drive $1.2 million in net income.

- B & C customer orders drive $390 & $115 in Variable Margin per line respectively. This does not cover labor, overhead, order management, pick & pack and handling costs.

- About 75% of our line activity drives less than 10% of our variable margin.

- We need to adapt our processes to manage each segment of our business

The best sales people for this client drove superior pricing at their “A” customers. The more desperate sales people were allowed to decide on pricing at “B” and “C” customers, and it showed. This showed that the company did not have good pricing controls in place. Addressing this drove an increase in EBITDA that was the equivalent of adding over $8 million in new sales.

In addition, 10% of the sales of this company drove 75% of their gross margin. Yet, the treated all SKU’s and customers the same. Seeing this in black and white enabled the management team to develop new channels, adopt some pricing policies on freight and lead times and update their production scheduling approach to protect “A” customers.

In this case, the 9-Box helped the management team see the impact of running the business like a life-style family business. The changes needed to drive the additional EBITDA also increased the service levels to “A” customers and reduced day to day stress throughout the company.

See the link below to download this case study.

Conclusion

While the 9-Box was designed to address inventory strategy, it also brings black and white visibility into actual pricing strategies in practice. It gives the management team, and their owners, a stark and sober look into opportunities to make all of your business segments profitable.

If you would like a copy of the 9-Box Case Study referenced above, click here.

About Bob Sherlock – Marketwerks, Inc.

Bob Sherlock works with executives of manufacturing and B2B services companies whose sales teams lack a compelling answer to “Why should I buy your solution from you—especially when you’re more expensive?” or “Lower your price.”

He helps his clients get paid what their solutions are really worth—and attract customers willing to pay more when they see value.

Bob is president of Marketwerks, a consulting firm focused on those objectives, and the author of Daring Caution: The Executive’s Guide to Pricing Improvement. Earlier, he was a ProAction Group principal, and founder of a venture-funded logistics service provider. Bob previously served as VP—Marketing for Wickes Lumber, and held increasingly responsible marketing and sales management positions in four GE operating businesses and on GE’s corporate marketing staff. He has an MBA from Dartmouth’s Tuck School of Business.