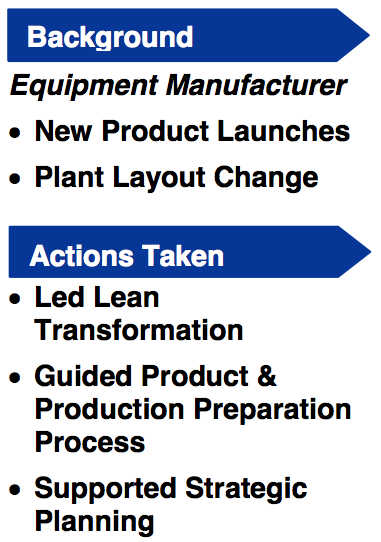

There would be no “snow days” in the forecast for a leading manufacturer of plowing and spreading equipment. The company was preparing to integrate a new acquisition and to launch two new products. To accommodate this growth, a major layout change and freeing up floor space was required at one of its facilities. Despite a lean effort for over a year, the plant’s performance was lagging behind the company’s other sites.

The ProAction Group reinvigorated the Lean transformation effort at the client’s plant with a hands-on application of Lean tools. We employed Value Stream Mapping to assess the opportunity and then began eliminating waste in the facility. The team used 5S, Visual Management, and Takt Time Management to streamline operations. Quick Changeover and Total Productive Maintenance were implemented to minimize downtime. We introduced metrics which allowed the plant to manage for daily improvement in its processes, including first-pass Standards of Work which eliminated costly re-work.

The ProAction Group reinvigorated the Lean transformation effort at the client’s plant with a hands-on application of Lean tools. We employed Value Stream Mapping to assess the opportunity and then began eliminating waste in the facility. The team used 5S, Visual Management, and Takt Time Management to streamline operations. Quick Changeover and Total Productive Maintenance were implemented to minimize downtime. We introduced metrics which allowed the plant to manage for daily improvement in its processes, including first-pass Standards of Work which eliminated costly re-work.

We led the Product & Production Preparation Process which ensured a timely and successful launch of the new products. The team employed a Design for Value approach with a focus on quality. We optimized the arrangement of people, machines, materials, and methods to maximize work flow and minimize waste.

ProAction also supported the client in constructing their strategic plans. We guided the roll-out of Lean practices across the entire enterprise. We conducted organizational capabilities assessments and recommended staffing changes. We also recommended sourcing activities to support the company’s expected growth.

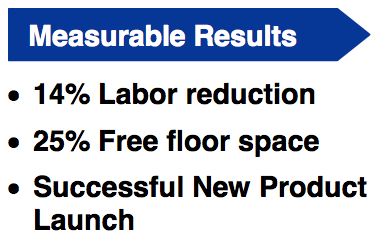

The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

Need help with Lean transformation at your company? Contact us today to learn how we can help.

Case Study: “Hidden” Operational Improvements Drive 50% Increase in EBITDA In 6 Months…

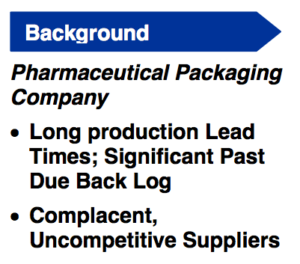

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets.

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets.

ProAction conducted the operational due diligence pre-close for its Private Equity client who was engaged in a competitive bidding process for the business.

Our tasks:

- Uncover and quantify any EBITDA improvement opportunities beyond those identified by management and the PE client

- Identify any hidden risks that would prevent the company from realizing their stated plans

We were successful on both counts.

- The “Hidden” Improvements in EBITDA and Working Capital Improvements: We quantified just over $1 million in EBITDA improvements, and $1.25 million in inventory reduction.

- These improvements primarily stemmed from 2 opportunities. The first related to lean manufacturing and scheduling opportunities in the plant. Their current approach to running the plant resulted in a significant past due backlog, high overtime costs, and late deliveries. The second related to their sourcing strategy and supply base. We found that they had no clear sourcing strategy and were laden with long term and untested suppliers.

- The Risk: The company’s IT system was stable, but not scalable. It was built on a set of 5 connected legacy systems and would likely need to be upgraded or replaced prior to a sale to a financial buyer.

- Given company plans for organic growth, the system would be fine for 3-5 years. We estimated the cost to implement a new system and the sponsor incorporated this into their financial model.

Our client used our information to update their model and our presentation to educate the lenders on the assumptions and evidence of the opportunities. With these enhancements incorporated into their offer, our client won the auction and acquired the company.

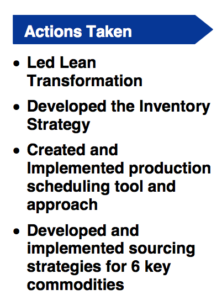

Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included:

Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included:

- Developing and implementing actionable sourcing strategies for six (6) different commodities.

- Creating a lean scheduling methodology/process for strategic stocking levels and delivery improvement.

- Running kaizen and other improvement events, teaching the plant personnel to conduct root cause analysis and take corrective action (we taught the organization how to improve habitually on their own)

- Providing training on Lean Methods Tools to management and operators.

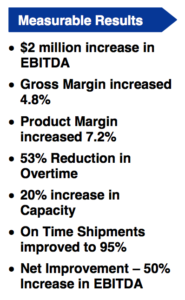

As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.

As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.

Within 18 months of acquiring the company, our Private Equity client refinanced and took their money off the table. Within 36 months they monetized the investment and netted a strong return, all without a meaningful increase in the top line of the company.

Simple EBITDA Enhancements – Bannockburn Global Forex, LLC

“A proactive approach to foreign currency transactions and exposures is among the least understood yet quickest ways to enhance EBITDA for PE funds or their middle market portfolio companies.”

Bannockburn Global Forex, LLC is an important alliance partner of The ProAction Group. Their team has helped us identify opportunities to increase EBITDA in our PRE-close diligence and they have helped our clients dramatically reduce their costs to operate internationally. Keep reading to learn more about their process of implementing simple EBITDA enhancements.

YOUR SOLUTION

Bannockburn Global Forex, LLC is a boutique currency trading and advisory firm, dedicated to the needs of financial sponsors and their middle market operating companies. Bannockburn’s currency experts become an extension of your team to assure the most efficient execution of cross border transactions at the fund and portfolio level.

TALK TO US IF YOUR FUND OR PORTFOLIO COMPANIES

- Engage in cross border M&A

- Import, export, or have global operations

- Consider foreign currency denominated capital expenditures

- Are exposed to earnings volatility driven by currency fluctuations

WHAT YOU WILL RECEIVE

- A forensic analysis of your past transaction activity to quantify cost savings potential

- An easily implemented solution that delvers efficient and transparent pricing going forward

- Expert detailed guidance on risk exposure and risk management strategies