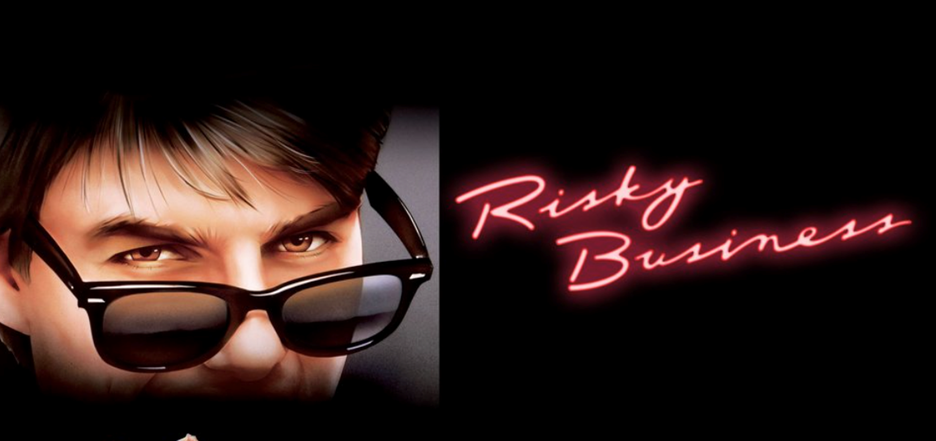

Who could forget the 1983 comedy drama, “Risky Business” starring Tom Cruise in his breakout role. Joel, the entrepreneurial title character, is plagued by unforeseen risks as he agrees to a less than transparent business plan to run a temporary brothel out of his parent’s home – all to pay for damage to his dad’s car. Well intentioned – though fraught with risk!

Tom Cruise may have learned a lesson from his risky behavior. The car in the lake became the least of his problems! In business and in real life the risks are often subtle and can even masquerade as harmless or irrelevant facts of life.

ADDRESSING RISK REQUIRES AWARENESS, ACCEPTANCE AND ACTION

Unrecognized risks do not get addressed. We can have sympathy for people and companies that suffer the consequences of something they truly didn’t know about. And that highlights an important point. Intention and ignorance do not protect us from harm. Sometimes the risk doesn’t show symptoms until late in the process.

Risks identified early can be mitigated, planned for, and addressed. On top of that, when addressing risky business early, the cure tends to be non-invasive, low cost and effective. The secondary, and often overlooked benefit is that eliminating risk will provide collateral benefit in seemingly unrelated areas.

When assessing operational risk, even during a pre-close due diligence, we search for early risk indicators, especially in the following areas:

- Safety

- Margin Compression

- Business Interruption

- Unbudgeted Capital Expenditures

- Obstacles to Scalability / fragility

- Customer Loyalty / Attrition

- Sensitivity to economic headwinds / black swan events

- Over / Under Estimated Capacity

- The Rabbit Hole (resources are being applied energetically in an irrelevant or unactionable area)

If none of the risks above got your heart pumping, you may skip the rest of this post!

Examining risk is not just an exercise in avoiding pain or bad situations. A clever and practical assessment of the risks can expose costly surprises before the deal closes. Go in with your eyes open, your models accurate, and your value creation plan relevant.

And here is the punchline. In 20 years of conducting operational diligences, we have never killed a deal. Every risk, especially when identified early, has a solution… modest capital, some appropriate management attention, some one-time resources.

The second punch line… When done well, the inoculation to the risk provides its own ROI. Addressing margin compression leads to increased margins. Shoring up against business interruption risk will create new stability and increase capacity. Increasing worker safety will help you scale.

Have you ever gone to bed one night thinking about how you are preparing to exit a deal and wake up to the reality that you have to, essentially, start over? Margins are falling, quality issues popped up, a customer moved to a competitor. The trick here is not to avoid unforeseen headwinds, or to avoid change. The answer is to prepare to handle change. We know more black swan events will come, and the vaccination is healthy, good, and available.

The ProAction Group has a team of professionals ready to turn on the proverbial flashlight… and venture into the dark spaces to provide knowledge of risks that are actionable and almost always – solvable.