In today’s fast-paced deal making environment, diligence efforts focused on operations may fall by the wayside or become less rigorous. After all, “operational diligence” hasn’t traditionally been one of the core “checklist” items. But there are compelling financial reasons for Private Equity firms to make operational diligence a primary focus BEFORE acquiring any new asset. With a thorough understanding of a target company’s operations, PE firms can eliminate costly surprises after the close and can maximize latent EBITDA opportunities.

Quality of Earnings (Q of E) reports are helpful, but in today’s deal environment, PE firms need to go deeper to fully understand the potential of a target and improve their competitiveness in the bid process. A Quality of Company Operations report looks at how management runs the company today and determines what EBITDA should be.

A Quality of Company Operations report answers four basic questions:

- What is the likelihood that the company can replicate current performance in the future?

- What risks exist that endanger the stability of EBITDA and free cash flow?

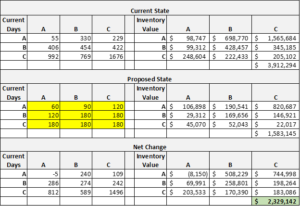

- What is the financial impact of realizing the latent or hidden value within the company? (This includes impact on EBITDA, working capital, capacity, lead times, retention, employee engagement, sustainability, safety and more.)

- What fundamental changes are needed to scale the company?

PE firms that gain a deep understanding of each target company’s operations have the information they need to refine valuations for competitive bidding and walk away from bad deals. Knowledge is Power – and thorough operational diligence helps ensure that PE purchases are sound investments.

Ways to Leverage Operations Experts Prior to an Acquisition

There are different ways a PE firm might utilize operations consultants prior to closing on an acquisition. Each brings different levels of engagement and insight.

Confidential Information Memo (CIM) Review: The PE firm sends the operations consultancy the CIM presentation. Upon review of the provided materials (and often more importantly, what isn’t included), the operations consultancy delivers salient insights that provide a guide for areas of opportunity and risk that need to be explored prior to closing a deal. Because of the consultancy’s deep operational expertise, they can suggest to PE firms specific areas of inquiry or concern that can help them better understand the prospective investment. This document can also provide scope for a deeper Quality of Company Operations diligence assessment.

Quality of Company Operations Report: This report provides deep and granular operational information for the PE diligence team. Typically, the operations consultancy participates with the PE firm in document review and management presentations and has additional access to target company employees and data. Operations experts determine the validity of management assumptions on areas such as revenue gains, productivity, capacity, capital expenditures, ability to serve customers, and more. They also provide insight on the operations capability of the management team and personnel. Upon delivery of the Quality of Company Operations report, PE firms walk away with the thorough operational insights necessary for making investment decisions.

Planning and Implementation: A change of ownership is a natural time to assess the company and implement change. Findings of the Quality of Company Operations report form the basis for development of a 100-day quick-start plan. Operations consultancies can partner with the management team early (sometimes even before the close) to implement sourcing, lean manufacturing or other operating “quick kills” to hit the ground running and accelerate the pace of change. A strong partnership between the consultancy and management early on increases the likelihood of success.

The ProAction Group Partners with Leading PE Firms to Provide Pre-Close Operational Diligence

The ProAction Group specializes in providing operational expertise for Private Equity firms. The company has deep experience in the acquisition and implementation environment and knows how to interact with deal teams, lenders and other advisors in a time-efficient and productive manner. The ProAction Group is also highly skilled at working constructively with target company management and knows how to build trust with boards, management teams and employees alike. The ProAction Group helps ensure sound investment decisions and enables a smoother sale and faster results after the close.