We’ve got some key insights and questions to ask at your next leadership meeting

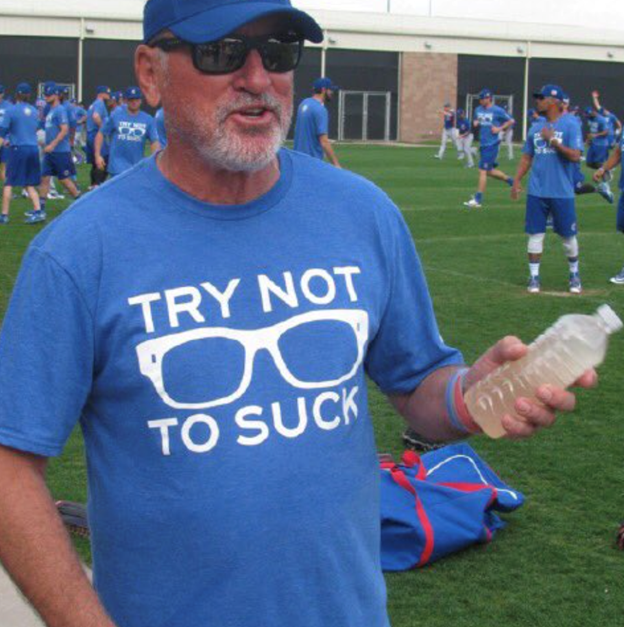

Former Chicago Cubs Coach, Joe Maddon famously told his Cubbies “Try Not To Suck” as a light-hearted way to inspire action. Simple and direct. His leadership ended the 100-year Cubs World Series drought.

Economists are still dancing around the issue, but the reality is we are likely headed into a recession. As businesses survived the worst of the pandemic, the murder hornets, civil unrest, supply chain issues and sky-high energy prices – now comes the recession.

What does history tell us? As you lead a portfolio of companies, “trying not to suck,” is a low bar. You’ve got pressure to make sure the results are there for a winning exit.

In their 2010 HBR article “Roaring Out of Recession,” the researchers found that during the recessions of 1980, 1990, and 2000, 17% of the 4,700 public companies they studied fared particularly badly: They went bankrupt, went private, or were acquired. But just as striking, 9% of the companies didn’t simply recover in the three years after a recession—they flourished, outperforming competitors by at least 10% in sales and profits growth.

A more recent analysis by Bain using data from the Great Recession reinforced that finding. The top 10% of companies in Bain’s analysis saw their earnings climb steadily throughout the period and continue to rise afterward. A third study, by McKinsey, found similar results.

The difference maker was preparation and execution. Among the companies that stagnated in the aftermath of the Great Recession, “few made contingency plans or thought through alternative scenarios,” according to the Bain report. “When the downturn hit, they switched to survival mode, making deep cuts and reacting defensively.” Many of the companies that merely limp through a recession are slower to recover and never really catch up.

How should you guide your portfolio companies in advance of a recession and what moves should it make when one hits? We’ve got some great tips and questions to challenge your leadership team:

OPERATIONAL EFFICIENCY IS A GAME OF INCHES

Companies that are even marginally better than their competition can steal market share in good times AND in bad times. As we face recessionary pressure, it’s good to challenge your leadership team with two key questions:

How will we maintain a consistent flow of supply with tight labor markets and a volatile supply chain?

How will we tighten the belt during a slow period while optimizing our ability to serve customers and protect employees?

THE NEED FOR SPEED

Speed of execution is extremely important for business momentum. The plan to achieve numbers cannot be with big cuts or to pause initiatives due to recessionary fears. Our advice – proceed with caution and reframe initiatives as an investment with a clear ROI for each initiative.

The sooner a portfolio company can find and mine hidden value, the higher the ROI once it is ready for a sale. Some challenging questions to pose:

As an organization, do we have self-paced obstacles that slow our pace down to needed improvements or identifying opportunities to create value?

Where can we gain scalability and speed?

In addition to budgeting operational improvements into the budget, can we also allocate “excess availability” within working capital lines of credit to ensure improvements can continue to happen if things get tight during the recession (if cash flow in the ordinary course of business is a problem)?

QUESTION DATA WITH FEEL

Coach Maddon told his players there is a healthy tension and balance between art and science, between data and winning strategy. Sometimes as a leader you must go with your gut and instincts (while also evaluating data and performance).

As a PE firm with multiple portfolio companies, perhaps 1 or 2 of the companies are hitting grand slams consistently. Maybe a few companies are always striking out. Perhaps a few of your companies are hitting singles and doubles, but you feel the potential is there. We would recommend focusing operational improvements on companies hitting singles and doubles – turn those into triples and home runs. These companies demonstrating positive performance (but still not quite there) could benefit from focus.

PHONE A FRIEND

Do you have one company in your portfolio that is already challenging your patience, mental capacity, and time?

Do you want to get ahead of impending situations before they go from bad to worse?

At The ProAction Group we do three things:

1. Conduct a Pre-Close Operational Diligence

- Like a QofE, but with a focus on Operations

- Quantify “how much more will you make when you run it right?”

2. Implement

- Drive initiatives to increase EBITDA and to improve your position in the market.

- Guide your management team to scalability.

- Get rid of the pain.

3. Revitalize Stale or Stagnate Portfolio Companies

- Do you have one portfolio company that requires more thought and effort than all the others combined?

Call us today so we can help you ensure your portfolio companies come out of the recession with winning returns. There is no time to waste!