Big EBITDA Gains Identified in Overstocked, Underperforming Portfolio Company

Eight years after purchasing a consumer product company, our private equity client found themselves in the frustrating position of spending too much time and attention on one underperforming portfolio company.

The issues were clear: inventory kept increasing, and management was at a loss to explain why. Matters were further complicated by some of the inventory’s limited shelf life. Though demand was very seasonal, at the end of their last busy season the company had the highest inventory levels in its history. These issues resulted in an EBITDA to sales ratio of less than 6.5%: earning less than $6.4 million in EBITDA on about $100 million in sales.

Exiting the underperforming company wasn’t feasible, as it would result in mediocre performance for the client’s fund.

Background:

- Underperforming portfolio company had excess inventory; products with limited shelf life compounded losses.

- EBITDA performance lagged the industry and fell short of projections.

- Exiting would drag down overall fund performance.

ProAction performed a Sell Side “QofOps” to identify and quantify their opportunities to create and claim value before their exit. Here are the highlights:

- Recast Inventory: The company had $28 million in inventory, and we modeled how much they really needed given their supplier lead times, manufacturing capacity and customer locations. They only needed $12 million to run the company assuming solid processes and systems.

- Segmented the Business: One size does NOT fit all! We segmented the business into 9 segments. We learned where they made money and where they gave it back. This allowed us to develop surgical recommendations to project their position with important customers and their ability to serve other customers in a profitable manner.

- Targeted Savings: We examined their SG&A spend, their approach to sourcing purchased goods and services, and their DC’s and factories. This allowed us to quantify how much more EBITDA they can generate at the current sales levels.

- Re-designed Planning Processes: We reviewed the company’s supply and demand planning processes, and isolated opportunities to leverage supplier resources, reduce inventory, and increase order fulfillment levels.

- Fostered Adoption: By including key members of the management team in the design process, we were able to do more than deliver a report. We generated a detailed implementation plan and laid the foundation for change.

Actions Taken:

- Optimized processes around the 8% of customers and 22% of SKUs that make up 88%+ of gross margin produced.

- Built the business case to consolidate 4 facilities into 3.

- Designed a Lean enterprise and a planning culture, with tracking and monitoring methodology built into all processes.

Quantified Impact of Recommendations:

As part of building a business case for the recommendation, we estimated the net benefits of taking action. Namely, as a result of the identified changes, the client would realize the following net benefits:

- Increase EBITDA between 69% and 108%.

- Pay down up to $16 million in debt.

- Increase order fulfillment, customer satisfaction levels, flexibility and inventory turns.

- Reduce customer lead times.

- Fully leverage recent ERP.

About The ProAction Group

ProAction is an operational consulting firm that works with Private Equity to do three things:

- Help you win good deals (and avoid bad ones!) through our pre-close Operational Due Diligence and “Q of Ops” Diagnostic Reports.

- Facilitate your management team’s transition from an entrepreneurial to a scalable, process driven leadership path. We act as their training wheels.

- Conduct our Operational Diligence on “stale” portfolio companies. We quantify any latent value that can be freed up through operational changes.

We focus on three sectors: consumer products, manufacturing and distribution. We have experts in Lean Manufacturing, Six Sigma, Sales and Operations Planning, Inventory Strategy, Sourcing, Logistics and Human Capital Development. We were founded in 1995 and are headquartered in Chicago.

For Further Information:

Timothy Van Mieghem

tvm@proactiongroup.com

The ProAction Group, LLC

445 North Wells St. Suite 404

Chicago, IL 60654

Tel: (312) 371-8323

www.proactiongroup.com

The Competition is Fierce. Change the Rules. ™

The ProAction Group reinvigorated the

The ProAction Group reinvigorated the  The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

The Lean transformation put the plant back on track to meet performance expectations. We reduced the labor cost by 14%. Changing the plant’s layout improved the work flow by 32% and reduced the occupied manufacturing area by 25%, freeing up space for the production of its new products.

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets.

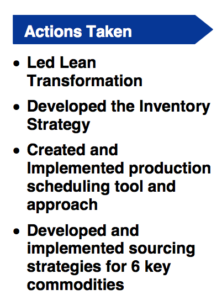

The company, a leading international provider of pharmaceutical packaging solutions, focused on the long term care, retail and nutraceutical markets. Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included:

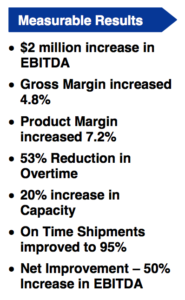

Post close, the company retained ProAction to work with management to implement the improvements identified during diligence. We led the company through the value stream mapping process and, together, created the road map. Key parts of the implementation phase included: As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.

As a result of these actions, annual EBITDA increased by $2 million, or 50%, in six months. The better news, however, is that this financial improvement was accompanied by increased service levels, reduced stress in the plant and a 20% increase in effective capacity. During this period, the top line remained steady.